Industry Insights

How COVID-19 Is Already Transforming the Financial Services Industry

To understand the impact of COVID-19 on the financial services industry, Yext has hosted several executive panels featuring marketing and digital leaders

To understand the impact of COVID-19 on the financial services industry, Yext has hosted several executive panels featuring marketing and digital leaders from across financial services segments. During these discussions, we've shared findings from Yext research on market trends, and have heard executives describe the impact of COVID-19 on their organizations, examine changing customer behaviors, and offer best practices for managing these changes.

When asked how financial services organizations anticipate COVID-19 will impact their business:

- 43% of respondents say they are seeing record activity and performance

- 14% say it's been hectic, but business is getting back to normal

- 29% say some areas are doing well but others aren't

- 14% say most areas are negatively impacted

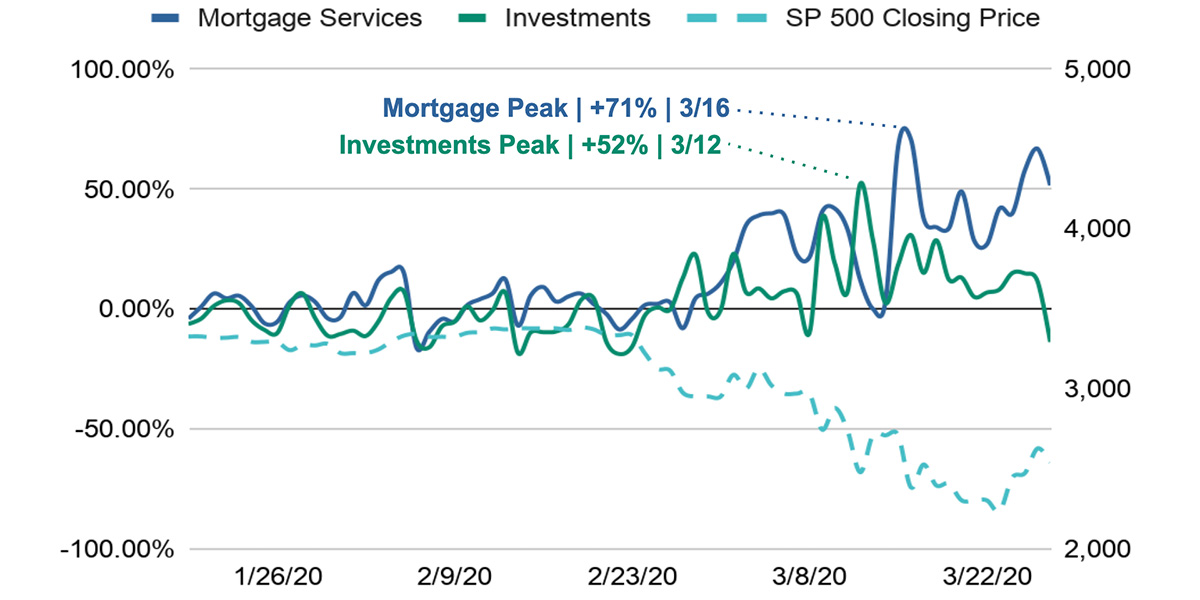

It's been a whirlwind of change for financial services markets due to COVID-19. The United States' first known case of the virus was reported on January 22nd. We then witnessed a ripple effect of macroeconomic and legislative events impacting every industry within financial services. Initially, shelter-in-place laws were enacted, which hit travel and hospitality industries particularly hard. Then, oil prices began to drop. On February 23rd, the S&P 500 started to dip, prompting the Fed to step in and cut rates on March 3rd to improve liquidity. Subsequently, the mortgage market took off, and now we are in a historic period of borrowing from SMB with the CARES Act. If just reading that made you feel dizzy, you're not alone — it was a dizzying few weeks for our economy, to say the least.

In this diagram, we can see how one event triggered the next — causing consumers to lock into rates to refinance their mortgages, and causing investors to rebalance their portfolios.

Several studies have shed light on how financial services organizations are reacting to COVID-19. In a recent Yext panel, we saw the following responses [from financial services executives]:

- 71% of executives state that all strategic priorities and projects that were identified last year are being reevaluated given the new COVID-19 reality

- 57% state they are trying to cut costs

- 29% state they will invest more in digital

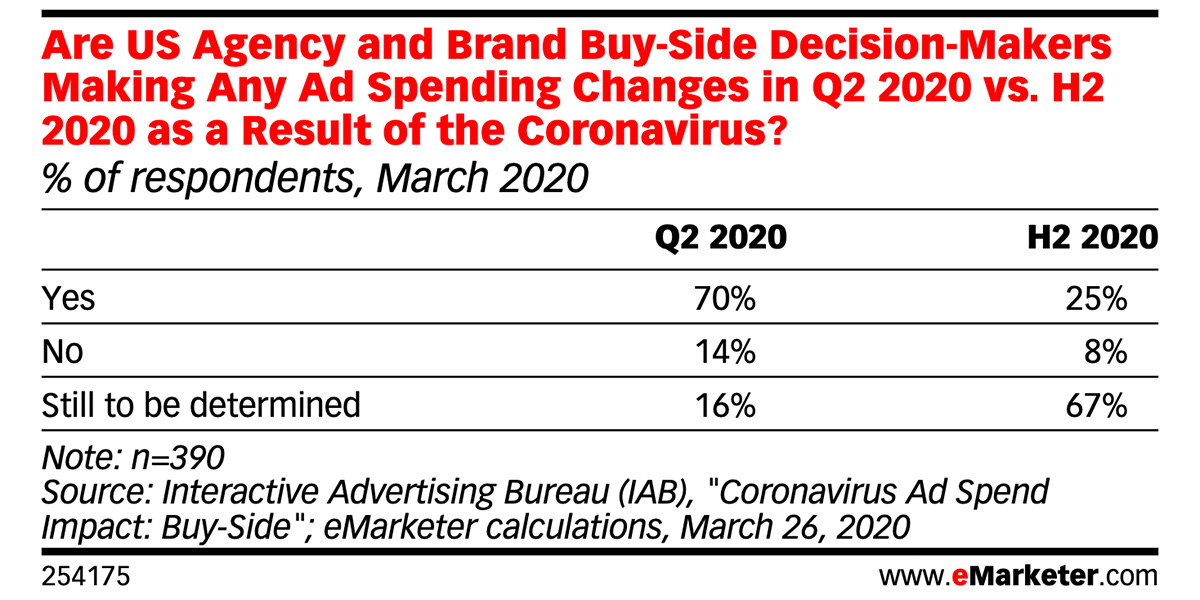

Gartner reinforces these insights with their own study, which found that organizations are reallocating media spend to improve communications and interactions with clients, and to support their workforce.

These are a few of the common types of communications that companies are digging into:

- Updating hours of operations or temporary closures for departments, branches, and financial professionals

- COVID-19 special announcements (e.g., special hours for the elderly, precautions being taken at facilities)

- Directing customers to digital self-service channels or touchless interactions (e.g., booking appointments online, drive-through capabilities, online banking or trading)

- FAQs around important announcements (e.g., SBA, mortgage, forbearance, and programs to help customers and employees)

Customers don't want to see ads. They need immediate assistance with critical business transactions. The sum of these experiences is defining brands — and it's separating the leaders from the laggards.

Of course, this is an actively unfolding situation, and the cascading domino effect of economic consequences will undoubtedly continue. But many financial services leaders already see this as the new normal. 71% of executives believe the COVID-19 crisis will have a lasting impact on customer behavior (with the remainder optimistic that consumers will revert back to old patterns). Executive strategies are being tested. And in the immediate wake of quick changes to business operations and customer communications, financial services leaders are asking questions like:

"Did we cut costs, or over-rotate on digital capabilities, to the point where it has limited human interaction?"

"Have we boosted or hindered our organization's ability to pivot to market trends?"

"Are we still offering consumers enough choice in the ability to transact or get advice?"

Financial services companies have the ability to rapidly innovate. It's built into their DNA. And it's one of the things we at Yext love most about working with brands in this industry. In the days ahead, this agility will prove more beneficial to these companies than ever.