Industry Insights

How Financial Services Organizations Can Rev Up Revenue With Reviews

Lousy reviews from critics have always influenced people to stay away from certain brands and businesses. But now that the internet has given anyone the ability to voice an opinion, the effect is much more pronounced.

Lousy reviews from critics have always influenced people to stay away from certain brands and businesses. But now that the internet has given anyone the ability to voice an opinion, the effect is much more pronounced: Nearly half of consumers (47%) say they would avoid using any business with less than a 4-star rating online. The fact is, whether your business sells bathrobes or bank accounts, online reviews are an incredibly important digital expression of your customer experience — and they are shaping consumer expectations across the board.

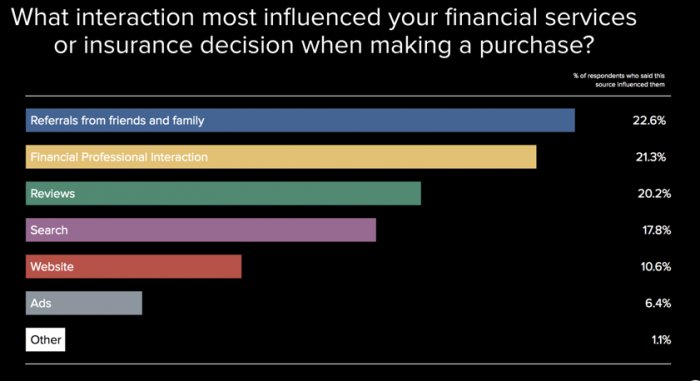

In the financial services and insurance industry, 80% of customers consider reviews extremely important to their purchase journey. American Banker calls this the "Amazon effect," suggesting that banks need to spend a lot more time thinking about their digital experience — and how that can impact their online reviews. When polled about the most important interaction in their purchase journey, our customers stated "a referral from a friend or family member," "talking to a financial professional," and "reading reviews online." What is profound is there is only a 2% difference between these different interactions. In fact, 31% of people go to 7+ places to fact check an organization, financial professionals or products when making an important financial decision.

Higher Rating = Higher Ranking

Higher Rating = Higher Ranking

Reviews aren't only about consumer interactions with products and services: More reviews and higher star-ratings have actually been shown to improve discoverability by way of a better search ranking. In other words, it's not just a better customer experience you need to worry about, but also a better algorithm experience. You're not just managing your online reputation for humans, but for the algorithms used by search engines — so that your brand shows up when consumers ask important questions related to financial services. If you're not managing your online reviews, you're missing out on search visibility and valuable clicks.

To illustrate with an example: Let's look at one of the most competitive mortgage markets in the US: Denver, Colorado.

If you want to buy an ad from Google to rank first against people searching for the top mortgage broker, you need to be prepared to pay up to $50 per click. So how is it that David Cook of Cherry Creek Mortgage ranks #1 in organic search for "best mortgage" — no ads required?

"During COVID, we've found that elevating the customer experience is more important than ever," explains David Arnett, VP of Marketing and Communications at Cherry Creek. Better customer experience, in turn, leads to more positive reviews — and therefore easier organic discovery on Google. "Reviews are an essential part of our business as they not only let us know the health of the borrower experience, but they also help our rankings on SEO and differentiate us from our competitors."

Three Tips to Drive Kudos (and Clicks!)

Ready to take control of your reviews to improve visibility and drive clicks from search results? Here are simple strategies to get started:

- Monitor your reviews. This might seem obvious, but it makes a big difference in terms of both preventing fraud and quickly improving customer satisfaction. Organizations that actively manage first party reviews see a 153% average increase in click through ratings.

- Start a review generation strategy. According to a Yext study, financial services and insurance is the fastest growing industry for reviews, showing a 91% increase in volume since last year. Make sure your business is set up to benefit from this boom. Another pro-tip: automate this strategy so it activates as soon as customers sign up for an account or a new product.

- Respond to reviews. Businesses in financial services and insurance that take the time to respond to reviews see an average 1.48 star rating improvement on average.

"We make sure to respond to all 1-3 stars within a few minutes to hours," Arnett says. "We've only had 20-30 one to three-star reviews in the past 3 years but each time, we reach out to the branch manager, the loan officer, and the consumer right away, making sure the consumer feels heard and validated."

In fact, in a few instances, the consumer not only deleted the negative review but changed it to 5-stars, according to Arnett.

Want to learn more about how you can implement these strategies? Register for the webinar we are hosting on November 12th with Adobe, CapGemini and Forrester here.

*Unless otherwise noted, statistical information from Yext research