State of Search

Holiday Search Trends 2020: How to Manage the Biggest Digital Season Yet

This time last year, we released our annual Holiday Search Trends report. As is typical for our annual report, our study focused on predicting foot traffic by examining when "get directions" clicks to businesses peaked on search engines.

This time last year, we released our annual Holiday Search Trends report. As is typical for our annual report, our study focused on predicting foot traffic by examining when "get directions" clicks to businesses peaked on search engines. The goal was to reveal when different types of businesses could expect a surge of shoppers at their doorstep, allowing them to prepare for — and take advantage of — the influx.

To state the obvious, we're now living in a very different world. Comparing metrics like "get directions" clicks to 2019 benchmarks isn't very useful in a world gone largely (and in some cases, exclusively) virtual. But there's still a lot that businesses can learn from the way consumer behavior has shifted during the past eight months of the COVID-19 pandemic. By combining new insights from these past eight months with our typical methodology, we've extrapolated to project what this unusual holiday season might look like for some of the verticals we work with. (Note: Projected percent changes are relative to autumn 2019 and January 2020, to account for both holiday seasonality and COVID-19's impact — see methodology.)*

Here are the takeaways:

1. In a global pandemic, Ecommerce is the only reliable commerce.

With rolling business closures and COVID restrictions reintroduced in parts of the United States, it makes sense that some verticals have taken a big hit to brick-and-mortar — but that makes the online funnel all the more important across the board. Website clicks are up significantly for key verticals like food services, retail, consumer electronics, and banking.

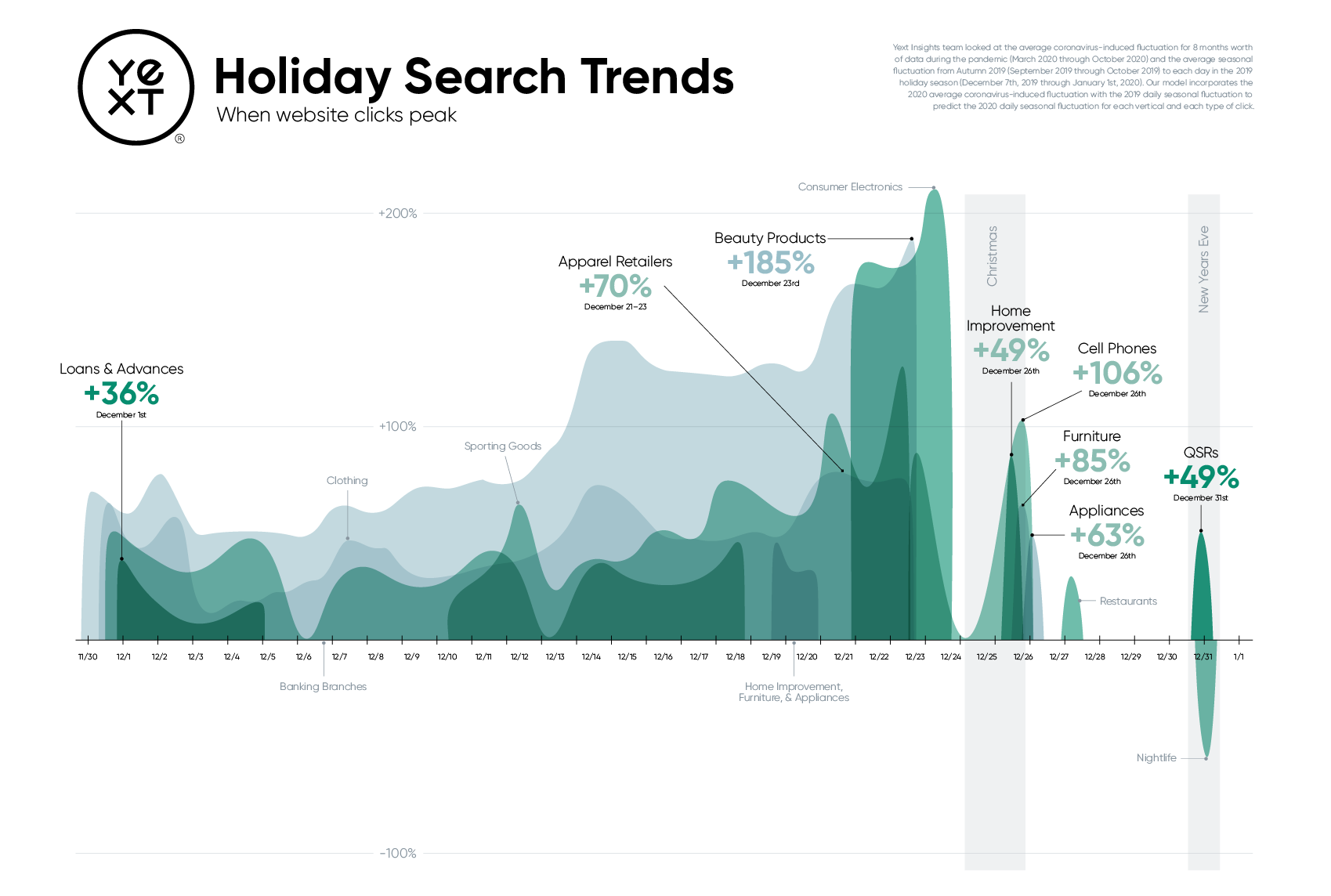

Ecommerce has grown significantly, and many retailers are capitalizing on more time spent shopping online (and via BOPIS programs) versus in-store shopping. Even where directions clicks have begun to rebound, website clicks have stayed above pre-pandemic levels, which indicates the increase in ecommerce is here to stay. Thus, investing in your website experience is important for businesses of all stripes. Here's how (and when) website clicks are spiking across industries this year:

To explore more stats by vertical, click here to check out the COVID-19: Yext Search Data Hub.

To explore more stats by vertical, click here to check out the COVID-19: Yext Search Data Hub.

2. Store visits have sunk, but these select industries are still set to soar.

In a year where digital interactions are taking the lead, it's true that foot traffic isn't what it used to be. That said, many people are still willing to visit a brick-and-mortar store, particularly for some big-ticket items. So, while many businesses are shifting the bulk of their operations online, there are some that are either more convenient or only possible by visiting a physical location.

Jewelry was previously a big hit a few days before Christmas, and it looks like consumers are still set to make these expensive, highly personal purchases in person: Clicks for "get directions" throughout the pandemic in the jewelry vertical show only mild hesitance to pick out the perfect piece in person. Prepare for about triple the directions clicks — and the subsequent foot traffic increase — in the days leading up to Christmas Eve (12/21/20-12/24/20).

While Black Friday didn't generate crazy foot traffic for Sporting Goods Stores last year, they can still expect about 60% more than normal two weekends before Christmas (12/12/20-12/13/20), and 2x normal directions clicks resulting in more foot traffic on the last weekend before Christmas (12/19/20-12/20/20). (Hanukkah might also be driving this trend from last year, so look for about 20-50% increases to foot traffic from 12/10/20 to 12/18/20 this year.) Why? Well, have you tried ordering even a simple set of dumbbells lately? It's harder than you might think. Shipping delays, low stock, and similar challenges might be causing more shoppers to look for these goods in person — so they can get started on their at-home workouts and outdoor activities in time for all those New Year's resolutions.

3. For a lot of us, 2021 can't come soon enough. This New Year's Eve, people will be bringing the party home — with major implications for retailers and restaurants alike.

With all the staying in this year, you might expect that there would be no need to get dolled up this holiday season, right? Not necessarily.

Beauty product shoppers are not slowing down. They've hit their favorite products' sites somewhere between "slightly more than normal" and "about normal," since the pandemic got under way, according to the Data Hub, suggesting that more of us are getting dressed up to stay in. The combination of healthy ecommerce for Beauty Product brands — and the typical Holiday bump these types of brands receive — leads us to believe that there will be a consistently high traffic to Beauty Product brands after Black Friday, with website clicks expected to be up about 50% higher than normal throughout the season, building to 185% more than normal on the day before Christmas Eve (12/23/20). For apparel retailers, clothing sees something similar, though slightly muted compared to beauty products, with seasonal tides expected to rise to a consistent 30% above normal after Black Friday and a high water mark of about +70% on the 21st, 22nd and 23rd of December.

Combining those stats with the trends we're seeing in nightlife and dining, we predict that revelers will be bringing the party home on New Year's Eve. We're projecting "Sit-down" restaurants to receive -41% of the directions clicks that they normally receive on New Year's Eve, as the negative impact of the pandemic far offsets the usual holiday bump. But while glamorous nights out might be, well, "out" this year, getting cozy and staying in with your pod is very "in." Just check out website clicks to Food Services: We're predicting frequent 20% bumps in local website clicks for both Fine Dining and QSR over the holidays, with more customers looking to place orders for pickup or delivery. We predict the highest peak for quicker service restaurants comes on New Years Eve (12/31/20), with 49% more website clicks than usual, meaning it's time for these businesses to get their listings in top shape — and their websites ready for a deluge of questions.

4. The not-so-surprising trend for a mid-pandemic holiday? Urgent care will see a lot of traffic.

While driving directions for doctors and physicians will drop off almost entirely over the holidays, urgent care centers can expect to pick up the slack: We predict driving directions will be up +18%, +21% and +19% on the 21st-23rd. (The only days requests for driving directions will be down? On Christmas Eve (-47%) and Christmas Day (-65%), as patients may look to avoid coming in for treatment on the actual holidays.)

Website clicks, on the other hand, will be high throughout the holidays, so healthcare organizations — and especially those urgent care centers — should make sure their websites are in top shape. They can also expect huge jumps in website clicks to the tune of between 30% and 90% leading up to a quiet Christmas Eve and Christmas Day (0% and -13%). Then, we estimate spikes of +127% and +201% on the 26th and 27th, tapering off to +56% on New Year's Day.

5. Prepare for a rise in phone call clicks — and equip your website to answer questions

Phone calls clicks from Google have been on the rise over the past year, as people seek help from customer service channels when they can't get their questions answered through search. But it's not just irate customers: A recent social media survey conducted by Yext showed that about half of respondents who called a business said they were calling to confirm that the store was open, despite what they may have seen on Google.

This brings up an important question about how much people can trust what they see on Google for a question as basic as "are you open right now?" With information from hours to offerings changing so rapidly due to the pandemic, customers need a source they trust more than third-party listings: They need online information right from the source — which highlights the growing need for businesses to provide answers people can trust through their own website.

As we wrote earlier this year, website visits from consumers seeking information about businesses have skyrocketed during the pandemic. This tells us that customers are showing their willingness to turn to online self-service offerings, and it makes sense for companies to further invest in these tools. Improving site search functionality can help businesses deal with the deluge of requests they're facing right now — leading to a more positive and effortless customer experience and increased brand trust — while also lowering support costs.

That's great long-term planning, but right now, we theorize that both website clicks and phone calls will increase this holiday season. Businesses need to get ready to answer customer questions with a two-pronged attack: Improving their website's ability to answer questions and prepping their customer service team.

Retail can expect to get inundated with phone calls throughout the holiday season, as buyers have more detailed product questions, questions about items in stock, or they simply want to find out if a store is open. Most sub-verticals within retail can expect to see between 20-40% more calls than normal on weekdays, particularly for larger purchases. Jewelry can expect to see a 362% spike, and Luggage & Leather Goods can expect to see a 315% spike in calls on the day before the day before Christmas (12/23/20) and about 2-3x the days immediately afterward. If your plan for dealing with this torrent of phone calls is, "please hold?" or "we are experiencing higher than normal call volume…" don't say we didn't warn you! Get your website ready now to answer as many queries as possible — and keep prepare your support staff to tackle the more complex questions that come through anyway.

With interest rates at their lowest since 2016 and the housing market on fire, Mortgage Services are also receiving more calls than normal. MLO's can expect about 50% more calls than normal every Monday of this holiday season, while Bank Branches can expect closer to 80% on Mondays. Both subverticals can expect more muted weekdays after Mondays, with most other days during the working week expected to be closer to 20-30%. Homebuyers will be looking for professional guidance (Uncle Lou doesn't count) throughout the process… so if you are a Bank or Mortgage Loan Officer, make sure you have a plan to make yourself available for questions.

Finally, 'tis the season for sending gifts… and Mailing Services can also expect big lifts in phone calls, to the tune of +105% to +136%, the week before Christmas (12/14/20-12/18/20). The day before Christmas Eve (12/23/20) might get even more volume (+176% more than normal). Businesses should get ready for those "will this ship in time?" questions and have a plan for addressing them via both on-site search and over the phone.

Deck the (digital) halls

As more Americans look to keep their loved ones safe by keeping a distance, this holiday season is unlikely to look like any we've seen before: Massive foot traffic to physical stores and large-scale festive gatherings are on hold until 2021.

But that's all the more reason for businesses to deck the (digital) halls by getting ready for more clicks — and more online questions — than ever. By updating your listings before these key dates, supercharging your site search experience, and knowing when to expect an influx of calls, businesses should still be able to see high holiday sales — and spread (virtual) holiday cheer.

**Methodology: The estimated impact of the coronavirus pandemic on the volume of clicks for directions, clicks to websites and phone call clicks for the upcoming 2020 holiday season is estimated by the sum of the seasonal growth in the volume of clicks during the holiday season in 2019 plus the change in the volume of clicks since the start of the coronavirus pandemic in March 2020 versus a pre-pandemic baseline in January 2020. The seasonal growth in the volume of clicks during the holiday season in 2019 was estimated by comparing the daily average volume of clicks in autumn 2019 (September 2019 through October 2019) to each day in the 2019 holiday season (December 7, 2019 through January 1, 2020). The change in the volume of clicks since the start of the pandemic was estimated by comparing the volume of clicks each day from March 2020 through October 2020 to the daily average volume of clicks in January 2020, taking the daily average fluctuation to acquire an average impact of the pandemic. Volume of clicks was examined by vertical and each type of click. Projected percent changes are relative to autumn 2019 and January 2020, to account for both holiday seasonality and the impact of the pandemic. These estimates are not a guarantee of future results, performance, or events and such estimated changes may not occur or be achieved.