Industry Insights

Revisions to the SEC Advertising Rule Mean Positive Change for Investors. Here’s Why.

When the Investment Advisers Act originally passed in 1940, it established regulations for what and how advisors were allowed to advertise their services to investors on traditional media such as TV, radio, and print.

When the Investment Advisers Act originally passed in 1940, it established regulations for what and how advisors were allowed to advertise their services to investors on traditional media such as TV, radio, and print. However, despite the explosion of digital over the last two decades, there have been no major updates to the advertising and solicitation rules in the past forty years to address these new mediums — until now.

On December 22 of last year, the SEC modernized the Investment Advertising Act as they attempted to balance improving the investor experience with maintaining the necessary controls and supervision to promote transparency and prevent fraud.

"This comprehensive framework for regulating advisers' marketing communications recognizes the increasing use of electronic media and mobile communications and will serve to improve the quality of information available to investors," stated the SEC Chairman Jay Clayton.

So what do these new rules* mean in practice for investment advisers — and why should they care?

Testimonials & Endorsements: Social media is crawling with people giving testimonials to the brands they love, and those brands are quick to promote those positive remarks. But the wealth management industry was the last bastion to embrace social, as fines for non-compliance on those platforms could exceed over 1 million dollars.

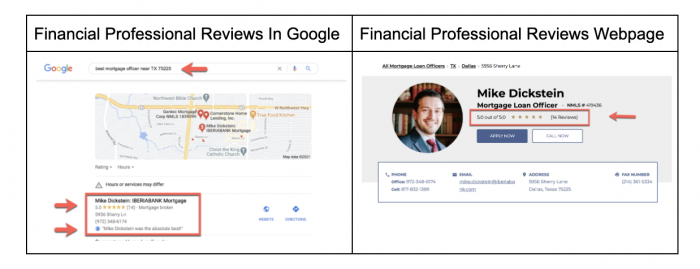

That's all changed. With the new rules in place, advisers are permitted to use testimonials or reviews subject to anti-fraud protections and other conditions. Reviews are important trust signals both for investors and search engines like Google.

- 80% of investors consider testimonials to be very important to their purchase decisions**

- Testimonials are a top trust signals for investors, just behind referrals from friends and family and talking to a financial advisor

- Responding to reviews can improve your overall star rating by 1.46 stars**

SEC Considerations: Work with your legal and compliance team to review and interpret the new SEC regulations and develop the right policies and procedures. Yext is here to help to provide the necessary tools so your teams can review content before it goes live. Below are some of the key considerations, but review the SEC regulations with your legal teams for others:

- You need to establish policies and procedures to avoid the general prohibition that apply to all advertisements. These general rules, for example, require the adviser to consider the context and totality of information presented such that it would not reasonably be likely to cause any misleading implication or inference.

- Disclaimers will be required, and we are glad to point you to the regulations and examples of clients using them for various situations and to see an industry precedent.

- You must gather information to draft required disclosures to accompany advertisements. For example, advertisements must clearly and prominently disclose whether the person giving the testimonial or endorsement (the "promoter") is a client and whether the promoter is compensated.

- Additional disclosures are required regarding compensation and conflicts of interest.

Third-Party Ratings: Advisors are permitted to use third-party ratings in their advertisements as long as the results are unbiased, are accompanied by required disclosures, and other conditions have been met. (Examples of third-party ratings include 4/5 stars on Google from Dec 2019-Dec 2020 or Barron's Top 100 Advisors for 2021.)

Even Google uses third-party ratings because it drives more clicks and leads.

Why Advisors Should Care:

Why Advisors Should Care:

- In paid media and email campaigns these third-party ratings can drive 10-30% more engagement.**

- In studies on Google show 167% engagement improvement leveraging third-party reviews. Learn from the digital giants: They have the smartest data scientists in the world, and they do it because it works.**

Take the next step in learning how Yext enables advisors and firms to manage reviews. We cover review management best practices and different ways to improve your reputation management strategy using reviews. Register for our upcoming webinar with TIAA, The Rudin Group, and Seismic or schedule a demo to see the product in action and ways to manage reviews.

*The revised rule will become effective 60 days after publication in the Federal Register. The Commission has adopted a compliance date that is 18 months after the effective date to give advisors time to comply with the new change.

**Yext research, 2019